Page 50 - Cgtmse

P. 50

23 Annual Report 2022-23

rd

Schedule

Forming Part of the Balance Sheet and Income and Expenditure Account

Why Service Tax of ₹`40,330/- should not be the additional provision suggested by Actuary in his

recovered on Penal Charges deducted while report is ₹`3,219.90 Crore as on 31.03.2023. Details of

making payment to M/s Path Infotech be covered provision for such claims are as under:

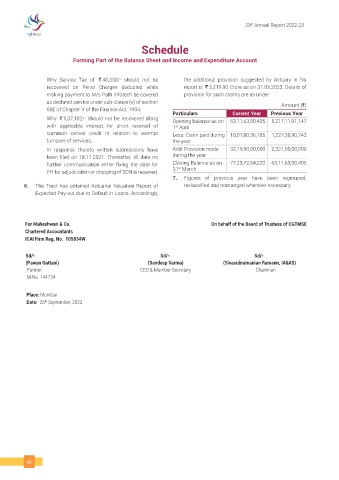

as declared service under sub-clause (e) of section Amount (`)

66E of Chapter V of the Finance Act, 1994. Particulars Current Year Previous Year

Why ₹`1,37,182/- should not be recovered along Opening balance as on 63,11,63,00,405 5,217,11,91,147

with applicable interest for short reversal of 1 April

st

common cenvat credit in relation to exempt Less: Claim paid during 18,07,80,36,185 1,227,38,90,742

turnover of services. the year

In response thereto written submissions have Add: Provision made 32,19,90,00,000 2,321,90,00,000

been filed on 18.11.2021. Thereafter, till date no during the year

further communication either fixing the date for Closing Balance as on 77,23,72,64,220 63,11,63,00,405

st

PH for adjudication or dropping of SCN is received. 31 March

7. Figures of previous year have been regrouped,

6. The Trust has obtained Actuarial Valuation Report of reclassified and rearranged wherever necessary.

Expected Pay out due to Default in Loans. Accordingly,

For Maheshwari & Co. On behalf of the Board of Trustees of CGTMSE

Chartered Accountants

ICAI Firm Reg. No. 105834W

Sd/- Sd/- Sd/-

(Pawan Gattani) (Sandeep Varma) (Sivasubramanian Ramann, IA&AS)

Partner CEO & Member Secretary Chairman

M.No. 144734

Place: Mumbai

Date: 26 September, 2023

th

48