Page 48 - Cgtmse

P. 48

23 Annual Report 2022-23

rd

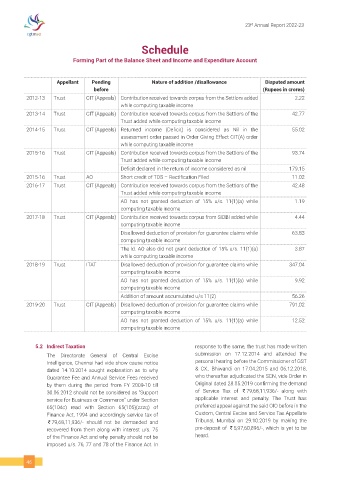

Schedule

Forming Part of the Balance Sheet and Income and Expenditure Account

Appellant Pending Nature of addition /disallowance Disputed amount

before (Rupees in crores)

2012-13 Trust CIT (Appeals) Contribution received towards corpus from the Settlors added 2.22

while computing taxable income

2013-14 Trust CIT (Appeals) Contribution received towards corpus from the Settlors of the 42.77

Trust added while computing taxable income

2014-15 Trust CIT (Appeals) Returned income (Deficit) is considered as Nil in the 55.02

assessment order passed in Order Giving Effect CIT(A) order

while computing taxable income

2015-16 Trust CIT (Appeals) Contribution received towards corpus from the Settlors of the 93.74

Trust added while computing taxable income

Deficit declared in the return of income considered as nil 179.15

2015-16 Trust AO Short credit of TDS – Rectification Filed 11.02

2016-17 Trust CIT (Appeals) Contribution received towards corpus from the Settlors of the 42.48

Trust added while computing taxable income

AO has not granted deduction of 15% u/s. 11(1)(a) while 1.19

computing taxable income

2017-18 Trust CIT (Appeals) Contribution received towards corpus from SIDBI added while 4.44

computing taxable income

Disallowed deduction of provision for guarantee claims while 63.83

computing taxable income

The ld. AO also did not grant deduction of 15% u/s. 11(1)(a) 3.87

while computing taxable income

2018-19 Trust ITAT Disallowed deduction of provision for guarantee claims while 347.04

computing taxable income

AO has not granted deduction of 15% u/s. 11(1)(a) while 9.92

computing taxable income

Addition of amount accumulated u/s 11(2) 56.26

2019-20 Trust CIT (Appeals) Disallowed deduction of provision for guarantee claims while 791.02

computing taxable income

AO has not granted deduction of 15% u/s. 11(1)(a) while 12.52

computing taxable income

5.2 Indirect Taxation response to the same, the trust has made written

The Directorate General of Central Excise submission on 17.12.2014 and attended the

Intelligence, Chennai had vide show cause notice personal hearing before the Commissioner of GST

dated 14.10.2014 sought explanation as to why & CX., Bhiwandi on 17.04.2015 and 06.12.2018,

Guarantee Fee and Annual Service Fees received who thereafter adjudicated the SCN, vide Order in

by them during the period from FY 2009-10 till Original dated 28.05.2019 confirming the demand

30.06.2012 should not be considered as “Support of Service Tax of ₹`79,68,11,936/- along with

service for Business or Commerce” under Section applicable interest and penalty. The Trust has

65(104c) read with Section 65(105)(zzzq) of preferred appeal against the said OIO before in the

Finance Act, 1994 and accordingly service tax of Custom, Central Excise and Service Tax Appellate

₹`79,68,11,936/- should not be demanded and Tribunal, Mumbai on 29.10.2019 by making the

recovered from them along with interest u/s. 75 pre-deposit of ₹`5,97,60,896/-, which is yet to be

of the Finance Act and why penalty should not be heard.

imposed u/s. 76, 77 and 78 of the Finance Act. In

46