Page 46 - Cgtmse

P. 46

23 Annual Report 2022-23

rd

Schedule Forming Part of the Balance Sheet and

Income and Expenditure Account

Schedule: 9: - NOTES ON ACCOUNTS: the Fixed Assets as per the Straight-Line Method

based on the basis of estimated useful lives as

1. Significant Accounting Policies

prescribed under the Companies Act, 2013.

a) Accounting Conventions

d) Investments

The accompanying financial statements have

been prepared keeping in view the generally Investments of the Trust comprise investments in

accepted accounting principles including historical Fixed Deposits with Banks / Financial Institutions

cost accounting. and Investments in Mutual Funds. Investments

in mutual funds are stated at weighted average

b) Recognition of Income and Expenditure cost less impairment, if any, during the year or

The Trust follows mercantile basis of accounting, market value, whichever is lower. Investments in

unless otherwise mentioned. The income Fixed Deposits have been stated at cost along with

recognition of major sources of income of the accrued interest thereon. Investments in Fixed

Trust are as under: Deposits with Banks relating to fund received from

the offices of DC (Handloom), DC (Handicraft),

Guarantee Fee PM SVANidhi Fund received from Ministry of

Income from Guarantee Fee is recognized Housing and Urban Affairs, GoI, CGSSD Scheme

when the payment from the respective Member Fund from Ministry of MSME, GoI and several

Lending Institutions is received / credited in the state funds have been identified and stated as

Bank Account on proportionate basis. Guarantee such in the Balance Sheet. Refer Schedule 4.

Fee received is allocated on proportionate basis

towards income for the year and income received e) Retirement Benefits

in advance considering period of Guarantee cover. Retirement benefits are provided by SIDBI for its

employees on deputation to the Trust and charged

Interest Income on Fixed Deposits to revenue account annually on reimbursement

Interest income on Fixed Deposits is recognized basis.

on accrual basis.

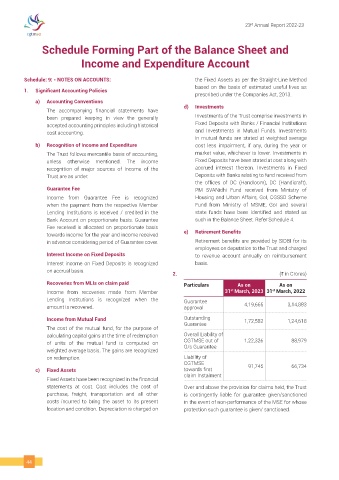

2. (` in Crores)

Recoveries from MLIs on claim paid Particulars As on As on

st

st

Income from recoveries made from Member 31 March, 2023 31 March, 2022

Lending Institutions is recognized when the Guarantee

amount is recovered. approval 4,19,665 3,14,883

Income from Mutual Fund Outstanding 1,72,582 1,24,618

Guarantee

The cost of the mutual fund, for the purpose of

calculating capital gains at the time of redemption Overall Liability of

of units of the mutual fund is computed on CGTMSE out of 1,22,326 88,979

O/s Guarantee

weighted average basis. The gains are recognized

on redemption. Liability of

CGTMSE 91,745 66,734

c) Fixed Assets towards first

claim Instalment

Fixed Assets have been recognized in the financial

statements at cost. Cost includes the cost of Over and above the provision for claims held, the Trust

purchase, freight, transportation and all other is contingently liable for guarantee given/sanctioned

costs incurred to bring the asset to its present in the event of non-performance of the MSE for whose

location and condition. Depreciation is charged on protection such guarantee is given/ sanctioned.

44