Page 47 - Cgtmse

P. 47

OVERVIEW FINANCIAL STATEMENTS

Schedule

Forming Part of the Balance Sheet and Income and Expenditure Account

3. The Trust pays 75% of the settled claim amount in the Assessment Year (A.Y.) 2002-03 to A.Y. 2006-07.

first instance, leaving balance amount to be paid after The Trust was registered u/s 12A of the Income

the conclusion of recovery proceedings. In 1,107 Cases Tax Act 1961 and accordingly it had claimed

(P.Y. 1,764 cases), subsequent payment of 25% has exemption u/s 11 of the Act for A.Y. 2007-08 and

been made. However, in other cases, the MLIs are yet A.Y. 2008-09. The Finance Act, 2008 amended

to report status of conclusion of recovery proceedings section 2(15) with effect from 1-4-2008 i.e. A.Y.

which makes them eligible for the receipt of the balance 2009-2010. Accordingly, the Trust had not claimed

claim. Further vide circular no.138/2017-18, the trust the benefit of section 11 from A.Y. 2009-2010

has introduced a cap on total claim settlement (i.e. onwards. However, the trust has made claim of

settlement of 1st & 2nd instalments of claim), based deduction of 15% u/s 11(1)(a) of the Act during the

on fee and recovery remitted by the MLI. Claims of the assessment proceedings.

respective MLI are settled to the extent of 2 times of the The Director of Income Tax (Exemptions) – [DIT

total of fees received and recovery remitted during the (E)] had vide order dated 07.12.2011 held that the

previous financial year.

activities carried out by the assessee trust are in

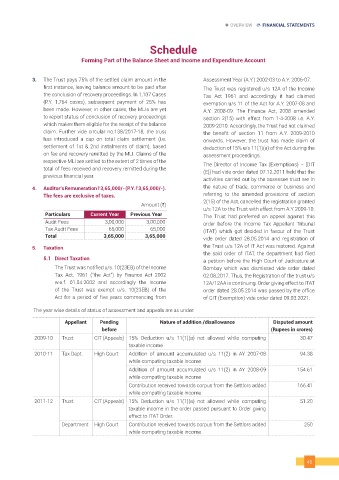

4. Auditor’s Remuneration ` 3,65,000/- (P.Y. ` 3,65,000/-). the nature of trade, commerce or business and

The fees are exclusive of taxes. referring to the amended provisions of section

2(15) of the Act, cancelled the registration granted

Amount (`)

u/s 12A to the Trust with effect from A.Y 2009-10.

Particulars Current Year Previous Year The Trust had preferred an appeal against this

Audit Fees 3,00,000 3,00,000 order before the Income Tax Appellant Tribunal

Tax Audit Fees 65,000 65,000 (ITAT) which got decided in favour of the Trust

Total 3,65,000 3,65,000 vide order dated 28.05.2014 and registration of

5. Taxation the Trust u/s 12A of IT Act was restored. Against

the said order of ITAT, the department had filed

5.1 Direct Taxation a petition before the High Court of Judicature at

The Trust was notified u/s. 10(23EB) of the Income Bombay which was dismissed vide order dated

Tax Act, 1961 (“the Act”) by Finance Act 2002 02.08.2017. Thus, the Registration of the trust u/s

w.e.f. 01.04.2002 and accordingly the income 12A/12AA is continuing. Order giving effect to ITAT

of the Trust was exempt u/s. 10(23EB) of the order dated 28.05.2014 was passed by the office

Act for a period of five years commencing from of CIT (Exemption) vide order dated 09.03.2021.

The year wise details of status of assessment and appeals are as under:

Appellant Pending Nature of addition /disallowance Disputed amount

before (Rupees in crores)

2009-10 Trust CIT (Appeals) 15% Deduction u/s 11(1)(a) not allowed while computing 30.47

taxable income

2010-11 Tax Dept. High Court Addition of amount accumulated u/s 11(2) in AY 2007-08 94.38

while computing taxable income

Addition of amount accumulated u/s 11(2) in AY 2008-09 154.61

while computing taxable income

Contribution received towards corpus from the Settlors added 166.41

while computing taxable income

2011-12 Trust CIT (Appeals) 15% Deduction u/s 11(1)(a) not allowed while computing 51.20

taxable income in the order passed pursuant to Order giving

effect to ITAT Order.

Department High Court Contribution received towards corpus from the Settlors added 250

while computing taxable income

45