Page 22 - Cgtmse

P. 22

23 Annual Report 2022-23

rd

13. Auditors

M/s. Jain Tripathi & Co., Mumbai, a firm of Chartered Accountants, was appointed as internal auditor

of CGTMSE, for the FY 2022-23. The Auditors undertook a comprehensive review of the entire

systems as also undertook audit covering revenue, expenses, investment, etc. As recommended by

the Comptroller and Auditor General of India, the Board appointed M/s. Maheshwari & Co., a firm of

Chartered Accountants, as Statutory Auditor of CGTMSE for FY 2022-23.

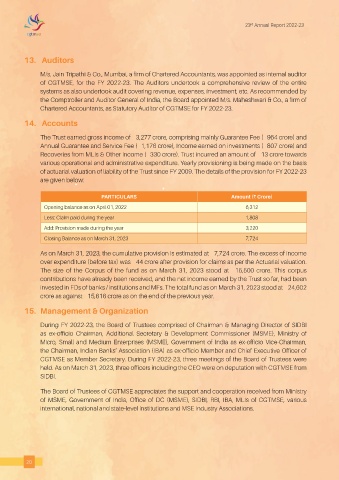

14. Accounts

The Trust earned gross income of ₹3,277 crore, comprising mainly Guarantee Fee (₹964 crore) and

Annual Guarantee and Service Fee (₹1,176 crore), Income earned on investments (₹807 crore) and

Recoveries from MLIs & Other Income (₹330 crore). Trust incurred an amount of ₹13 crore towards

various operational and administrative expenditure. Yearly provisioning is being made on the basis

of actuarial valuation of liability of the Trust since FY 2009. The details of the provision for FY 2022-23

are given below:

PARTICULARS Amount (` Crore)

Opening balance as on April 01, 2022 6,312

Less: Claim paid during the year 1,808

Add: Provision made during the year 3,220

Closing Balance as on March 31, 2023 7,724

As on March 31, 2023, the cumulative provision is estimated at ₹7,724 crore. The excess of income

over expenditure (before tax) was ₹44 crore after provision for claims as per the Actuarial valuation.

The size of the Corpus of the fund as on March 31, 2023 stood at ₹15,500 crore. This corpus

contributions have already been received, and the net income earned by the Trust so far, had been

invested in FDs of banks / institutions and MFs. The total fund as on March 31, 2023 stood at ₹24,602

crore as against ₹15,616 crore as on the end of the previous year.

15. Management & Organization

During FY 2022-23, the Board of Trustees comprised of Chairman & Managing Director of SIDBI

as ex-officio Chairman, Additional Secretary & Development Commissioner (MSME), Ministry of

Micro, Small and Medium Enterprises (MSME), Government of India as ex-officio Vice-Chairman,

the Chairman, Indian Banks’ Association (IBA) as ex-officio Member and Chief Executive Officer of

CGTMSE as Member Secretary. During FY 2022-23, three meetings of the Board of Trustees were

held. As on March 31, 2023, three officers including the CEO were on deputation with CGTMSE from

SIDBI.

The Board of Trustees of CGTMSE appreciates the support and cooperation received from Ministry

of MSME, Government of India, Office of DC (MSME), SIDBI, RBI, IBA, MLIs of CGTMSE, various

international, national and state-level institutions and MSE Industry Associations.

20