Page 18 - Cgtmse

P. 18

23 Annual Report 2022-23

rd

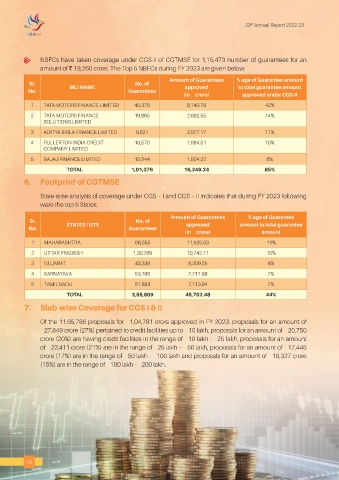

NBFCs have taken coverage under CGS-II of CGTMSE for 1,15,473 number of guarantees for an

amount of `19,260 crore. The Top 5 NBFCs during FY 2023 are given below:

Amount of Guarantees % age of Guarantee amount

Sr. MLI NAME No. of approved to total guarantee amount

No. Guarantees

(in ₹ crore) approved under CGS-II

1 TATA MOTORS FINANCE LIMITED 45,376 8,140.79 42%

2 TATA MOTORS FINANCE 19,865 2,662.55 14%

SOLUTIONS LIMITED

3 ADITYA BIRLA FINANCE LIMITED 9,621 2,077.17 11%

4 FULLERTON INDIA CREDIT 10,570 1,964.51 10%

COMPANY LIMITED

5 BAJAJ FINANCE LIMITED 15,944 1,504.22 8%

TOTAL 1,01,376 16,349.24 85%

6. Footprint of CGTMSE

State-wise analysis of coverage under CGS – I and CGS – II indicates that during FY 2023 following

were the top 5 States:

Amount of Guarantees % age of Guarantee

Sr. No. of

No. STATES / UTS Guarantees approved amount to total guarantee

(in ₹ crore) amount

1 MAHARASHTRA 66,055 11,925.53 11%

2 UTTAR PRADESH 1,30,769 10,742.11 10%

3 GUJARAT 43,336 8,209.05 8%

4 KARNATAKA 53,766 7,711.86 7%

5 TAMILNADU 61,883 7,113.94 7%

TOTAL 3,55,809 45,702.48 44%

7. Slab-wise Coverage for CGS I & II

Of the 11,65,786 proposals for ₹1,04,781 crore approved in FY 2023, proposals for an amount of

₹27,849 crore (27%) pertained to credit facilities up to ₹10 lakh, proposals for an amount of ₹20,750

crore (20%) are having credit facilities in the range of ₹10 lakh - ₹25 lakh, proposals for an amount

of ₹22,411 crore (21%) are in the range of ₹25 lakh – ₹50 lakh, proposals for an amount of ₹17,445

crore (17%) are in the range of ₹50 lakh - ₹100 lakh and proposals for an amount of ₹16,327 crore

(15%) are in the range of ₹100 lakh - ₹200 lakh.

16