Page 17 - Cgtmse

P. 17

OVERVIEW FINANCIAL STATEMENTS

4. Operations under all Guarantee Schemes

During FY 2022-23, under CGS – I a total of 10,50,313 guarantees were approved for an amount of

₹85,522 crore as compared to approval of 5,30,808 guarantees for ₹42,463 crore in the previous

year. It may be seen that while the number of guarantees approved increased by about 98%, the

amount of approved guarantee has more than doubled during the FY. Cumulatively, as on March 31,

2023, a total of 60,20,176 accounts have been accorded guarantee approvals for ₹3,55,197 crore.

Total number of applications guaranteed under CGS–II during FY 2023 was 1,15,473 for an amount

of ₹19,260 crore. It may be seen that the amount of approved guarantee has increased by 40% as

compared to last year. Cumulatively, as on March 31, 2023, a total of 10,05,304 accounts have been

accorded guarantee approvals for ₹64,468 crore under CGS-II.

During FY 2022-23 guarantee coverage for 32 applications have been approved for an amount of

₹9.55 crore under CGSSD. The scheme was in operation till March 31, 2023.

During FY 2022-23, a guarantee for 10,24,594 applications have been covered under PM SVANidhi

for an amount of ₹1,683 crore.

The year was watershed year for the Trust as it approved guarantee of more than ₹1 lakh crore for the

first time since its inception. The Trust approved guarantee of ₹1,04,781 crore during the year.

During FY 2022-23, for all the Schemes, a total of 21,90,412 guarantees were approved for an amount

of ₹1,06,474 crore. Cumulatively, as on March 31, 2023, a total of 1,10,83,693 accounts have been

accorded guarantee approvals for ₹4,24,596 crore by CGTMSE under all the guarantee schemes.

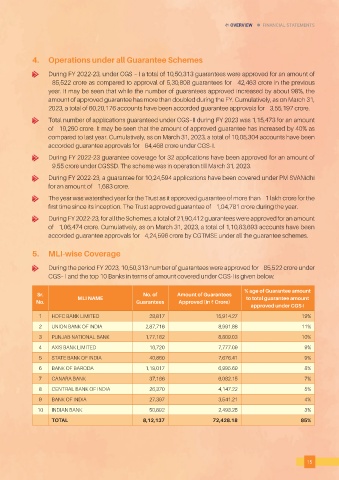

5. MLI-wise Coverage

During the period FY 2023, 10,50,313 number of guarantees were approved for ₹85,522 crore under

CGS– I and the top 10 Banks in terms of amount covered under CGS-I is given below.

% age of Guarantee amount

Sr. MLI NAME No. of Amount of Guarantees to total guarantee amount

No. Guarantees Approved (in ` Crore)

approved under CGS-I

1 HDFC BANK LIMITED 28,817 15,914.27 19%

2 UNION BANK OF INDIA 2,87,716 8,991.88 11%

3 PUNJAB NATIONAL BANK 1,77,182 8,809.03 10%

4 AXIS BANK LIMITED 16,720 7,777.09 9%

5 STATE BANK OF INDIA 40,860 7,676.41 9%

6 BANK OF BARODA 1,19,017 6,995.69 8%

7 CANARA BANK 37,166 6,082.15 7%

8 CENTRAL BANK OF INDIA 26,370 4,147.22 5%

9 BANK OF INDIA 27,397 3,541.21 4%

10 INDIAN BANK 50,892 2,493.25 3%

TOTAL 8,12,137 72,428.18 85%

15